Introduction

In the world of business and finance, securing a safety net is often paramount. One way to ensure that both parties in a contractual agreement remain protected is through a security bond. But what exactly is a security bond? In simple terms, it’s a financial guarantee provided by one party to another, ensuring that contractual obligations will be met. If you're venturing into how performance bonds work new business territories, understanding how to obtain a security bond can save you from potential financial pitfalls. This article serves as your comprehensive guide, breaking down every aspect of acquiring a security bond.

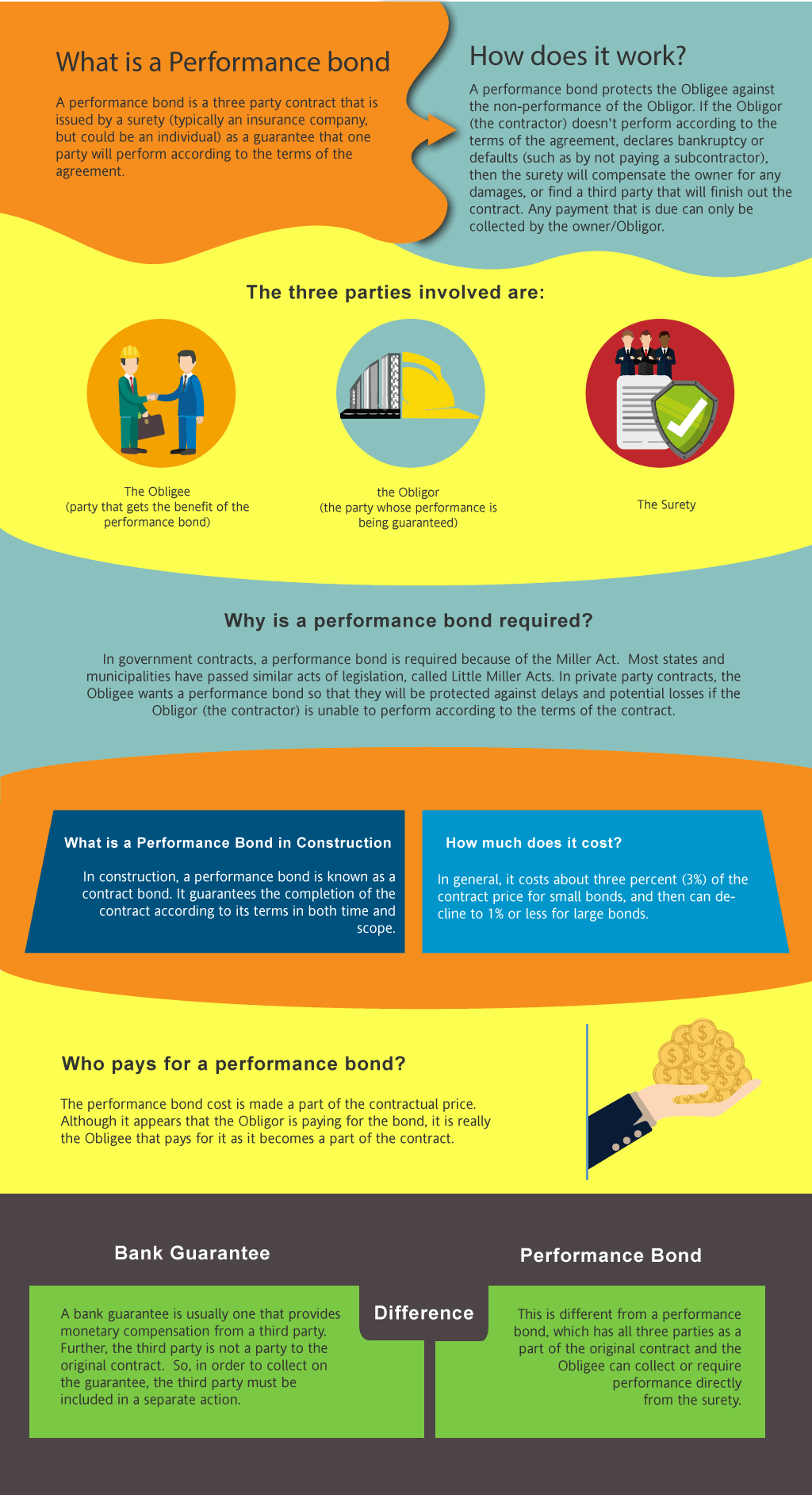

What is a Security Bond?

Defining Security Bonds

A security bond acts as a safety mechanism in various business transactions. It ensures that one party fulfills their contractual responsibilities. If they fail to do so, the bond guarantees compensation to the other party.

Types of Security Bonds

There are several types of security bonds tailored for different situations:

- Contract Bonds: These ensure that contractors fulfill their obligations. License and Permit Bonds: Required by government entities before granting licenses or permits. Court Bonds: Often used in legal proceedings.

Understanding these types helps clarify which bond suits your needs best.

Why Do You Need a Security Bond?

Protecting Your Interests

A security bond protects your investments and interests in any agreement. Whether you're hiring contractors or engaging in large-scale projects, having this layer of protection is invaluable.

Building Trust with Stakeholders

Having a security bond can enhance your credibility. It signals that you’re serious about fulfilling your obligations and encourages trust among stakeholders.

Step-by-Step Guide to Obtaining a Security Bond

Step 1: Assess Your Needs for a Security Bond

Before diving into the process, assess why you need a security bond. Are you entering into construction contracts? Or maybe you’re starting a new business requiring licensing? Identifying your needs will streamline the process.

Key Questions:

- What type of project are you undertaking? How much coverage do you need?

Step 2: Research Bond Requirements

Once you're clear on your needs, research specific requirements in your state or industry. Each jurisdiction may have unique regulations regarding security bonds.

Tips for Research:

- Consult government websites. Speak with industry experts.

Step 3: Gather Necessary Documentation

To apply for a security bond, you'll need various documents including:

- Business licenses Credit reports Financial statements

Organizing these documents ahead of time will expedite your application process.

Choosing the Right Surety Company

What is a Surety Company?

A surety company underwrites security bonds and is responsible for ensuring that claims made against the bond are valid. Choosing the right company is crucial for smooth processing.

Factors to Consider When Selecting a Surety Company

Reputation: Look for well-reviewed companies with solid credentials. Rates: Compare premium rates but remember that cheaper isn’t always better. Experience: Opt for companies experienced in your specific industry.Applying for Your Security Bond

Completing the Application Process

The application process generally involves submitting documentation along with an application form to the chosen surety company.

Common Sections on Application Forms:

- Personal Information Business Structure Financial History

Take care when filling out these forms; inaccuracies might lead to delays or denials.

Understanding Underwriting Process

Once submitted, the underwriting team evaluates risks associated with issuing your security bond based on financial information and creditworthiness.

Key Elements Evaluated During Underwriting:

Credit Score Financial Stability Industry ExperienceCosts Associated with Obtaining a Security Bond

How Much Does It Cost?

The cost of obtaining a security bond can vary based performance bonds on:

- Type of bond required Amount of coverage needed Your credit history

Typically, premiums range from 1% to 15% of the total amount secured by the bond.

Understanding Payment Options

You may have options such as:

- Annual payments Single upfront payment

Discuss these choices with your surety provider to find what works best for you.

Receiving Your Security Bond Certificate

What Happens After Approval?

After approval from the surety company, you'll receive your certificate of bonding. This document serves as proof that you've secured coverage under the specified conditions.

How to Use Your Bond Certificate

Provide copies of this certificate to relevant stakeholders involved in contractual agreements where bonding requirements exist.

FAQs About Security Bonds

1. What if I can't get approved for a security bond?

If denied, consider improving your credit score or addressing any negative factors highlighted during underwriting before reapplying.

2. Can I change my surety company later?

Yes! However, switching may involve additional costs like cancellation fees and obtaining new bonds from another provider.

3. Are there different regulations per state?

Absolutely! Regulations surrounding security bonds vary significantly by state; always check local guidelines before proceeding.

4. How long does it take to obtain a security bond?

Generally speaking, once all documentation is submitted correctly and thoroughly reviewed, obtaining approval can take anywhere from several days to weeks depending on complexity.

5. Can individuals also require security bonds?

Yes! Individuals may also require bonds especially when engaging in certain legal proceedings or starting businesses requiring licensing from government authorities.

6. What happens if I default on my obligations?

If you default on obligations covered by the bond, claims can be filed against it which may require payment from either yourself directly or through penalties imposed by courts depending upon circumstances involved!

Conclusion

Navigating through the maze of obtaining a security bond may seem daunting at first glance; however, following this step-by-step guide simplifies each phase of procurement while providing peace-of-mind knowing you’re taking proactive measures toward safeguarding both personal investments & professional relationships alike! Make informed decisions backed by thorough research & careful planning– it’s all part & parcel when dealing with such essential components within today’s ever-evolving landscape!

By adhering closely alongside these outlined principles regarding "Step-by-Step Guide To Obtaining A Security Bond", you're bound (pun intended!) towards success– ensuring all parties come away feeling secure throughout every stage involved!